town of oyster bay taxes star program

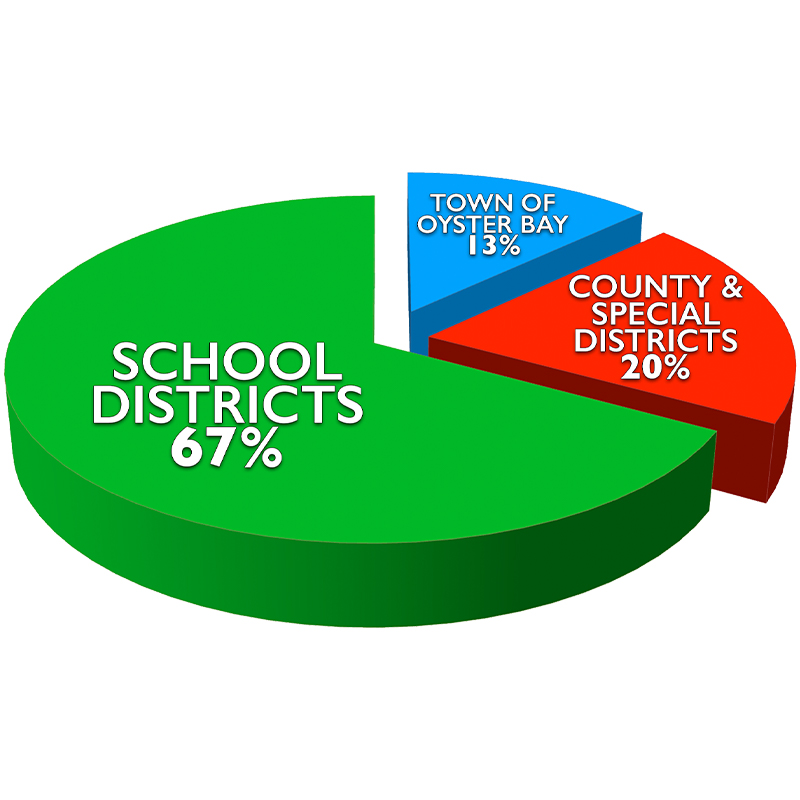

Current Basic Star Exemption recipients will. The Town of Oyster Bay Town is located in Nassau County covers an area of about 115 square miles and serves approximately 293000 residents.

Tax Exemptions Town Of Oyster Bay

164 rows 6242021.

. Register with New York State by telephone at 518 457-2036 or online at taxnygovpitpropertystardefaulthtm. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. Under the law all new construction must be completed by January 2 2023.

Homeowners wishing to receive exemptions on their 2020-2021 School taxes and 2021 General taxes must file with the Nassau County Department of Assessment or New York State prior to the January 2 nd deadline. The STAR program can save homeowners hundreds of dollars each year. New York States Enhanced STAR program provides eligible senior homeowners with relief on their property taxes.

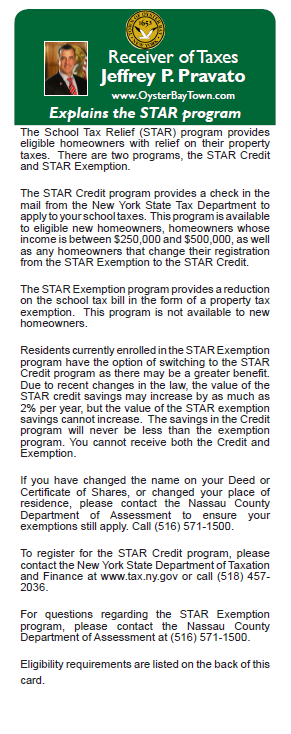

What exemptions are available under the STAR program. There are two programs the STAR Credit and STAR Exemption. Register with New York State by telephone at 518 457-2036 or online at wwwtaxnygovpitpropertystardefaulthtm.

NEW STAR APPLICANTS MUST REGISTER WITH NEW YORK STATE for the Personal Income Tax Credit Check Program by telephone at 518 4572036 or online. This State-financed exemption is authorized by Section 425 of the Real Property Tax Law. There are two programs the STAR Credit and STAR Exemption.

The above exemption amounts were determined using the latest data available. Town of Oyster Bay residents may apply for New York State property tax exemptions from now through January 3 2022 according to Oyster Bay Receiver of Taxes Jeffrey Pravato. Taxes can be paid online with an ACH check using a checking account for a small fee or by credit card for a much higher fee charged by the credit card companies.

City of Glen Cove. Register with New York State by telephone at 518 457-2036 or online at wwwtaxnygovpitpropertystardefaulthtm. You must apply for the STAR exemption.

This program is available to eligible new homeowners homeowners whose income is between 250000 and 500000 as well as any homeowners that change their registration from the STAR Exemption to the STAR Credit. Welcome to the Town of Oyster Bay. City of Long Beach.

The Countys assessment roll includes over 423000 properties with a value of 264 billion. For more information please call the Tax Office at 516-624-6400 or email receiveroftaxesoysterbay-nygov. For more information please call the Tax Office at 516-624-6400.

The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons. Oyster Bay Town Tax Receiver James Stefanich would like to notify residents of recent changes to the Enhanced School Tax Relief STAR Program. Two weeks prior to April 1.

It is the second largest assessing entity in the State of New York after New. If in the future a revised exemption is determined that differs by 5 or more from the exemption indicated a new exemption will be. Basic STAR Property Tax Exemption program provides an exemption from school property taxes for owner-occupied primary residences with an annual household income of 500000 or less.

63 rows School district name. There is no application needed for this exemption and will be based upon permit applications filed with your TownCityVillage. New York States Enhanced STAR program provides eligible senior homeowners with relief on their property taxes.

O Basic STAR Property Tax Exemption- this program provides an exemption from school property taxes for owner-occupied primary residences with an annual household income of less than 250000. Basic STAR Property Tax Exemption-this program provides an exemption from school property taxes for owner-occupied primary residences with an annual household income of less than 250000. STAR is the New York State School Tax Relief program that provides a partial exemption from school property taxes for owner-occupied primary residences.

The Board is responsible for the general management and control of the Towns fi nancial affairs. Microsoft has discontinued support of Internet Explorer. 1 The BASIC STAR exemption.

These exemptions are subject to change as more current data becomes available. Oyster Bay Town Tax Receiver James Stefanich would like to notify residents of recent changes to the Enhanced School Tax Relief STAR Program. The STAR Credit program provides a check in the mail from the New York State Tax Department to apply to your school taxes.

Online Tax Payment Portal. The STAR Exemption program. Class refers only to school districts that exercise the homesteadnon-homestead tax option or that are based within special assessing units Nassau County or NYC.

Homeowners wishing to receive exemptions on their 2022-2023 School taxes and 2023 General taxes must file with the Nassau County Department of Assessment or New York State. Four weeks prior to July 30. You only need to.

Get the Help You Need from Top Tax Relief Companies. Ad You Dont Have to Face the IRS Alone. The Tax Office has resumed limited in person access to both Town Hall North in Oyster Bay and Town Hall South in Massapequa and are open daily from 900 am to 445 pm to assist residents and accept payments with a check cash or credit cards.

Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay. Enhanced STAR Income Verification Program IVP The information on this page does not apply to new homeowners and first-time STAR applicants If youre a new homeowner or first-time STAR applicant you need to register for the STAR credit with the Tax Department instead of applying for the exemption. Oyster Bay Town Tax Receiver James Stefanich would like to notify residents of recent changes to the Enhanced School Tax Relief STAR Program.

Town of Babylon. New York States Enhanced STAR program provides eligible senior homeowners with relief on their property taxes. There are two programs the STAR Credit and STAR Exemption.

Current Basic Star Exemption recipients. The Town is governed by the Town Board Board which comprises the Town Supervisor and six Board members. The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in Nassau County on an annual basis.

The Town of Oyster Bay has issued a reminder that the New York State property tax exemption application period ends on January 2 2020.

Tax Exemptions Town Of Oyster Bay

Jeff Pravato Takes Over As Town Of Oyster Bay Receiver Of Taxes Oyster Bay Enterprise Pilot

Oyster Bay New York Ny 11771 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oyster Bay Inground Onground Pool Liner Pool Liner Pool Liners Inground Pool Liners

Departments Town Of Oyster Bay

Feds Propose Restoring Rules That Could Affect Oyster Bay Housing Discrimination Case Newsday

Property Tax Exemptions Available To Residents Syosset Advance

Cove Neck Oyster Bay S Historic Enclave Brief History Hammond John E Roosevelt Elizabeth E 9781467144377 Amazon Com Books

Long Island Community Sues Former Town Lawyer For Corruption

Oyster Bay Herald Guardian By Richner Communications Inc Issuu

Amazon Com Oyster Bay Images Of America 9780738565903 Hammond John E Books

One Bedroom Oyster Bay Ny Homes For Sale Redfin

Yassss Excellence Oyster Bay Is Coming Along Nicely And Will Open In Just A Few Days My Excellence Club Beach House Suite With Beach House Oyster Bay House

120 W Main Street Oyster Bay Ny Mls 3388371

Receiver Of Taxes Town Of Oyster Bay

Oyster Bay Herald 10 23 2020 By Richner Communications Inc Issuu

Tax Exemptions Town Of Oyster Bay